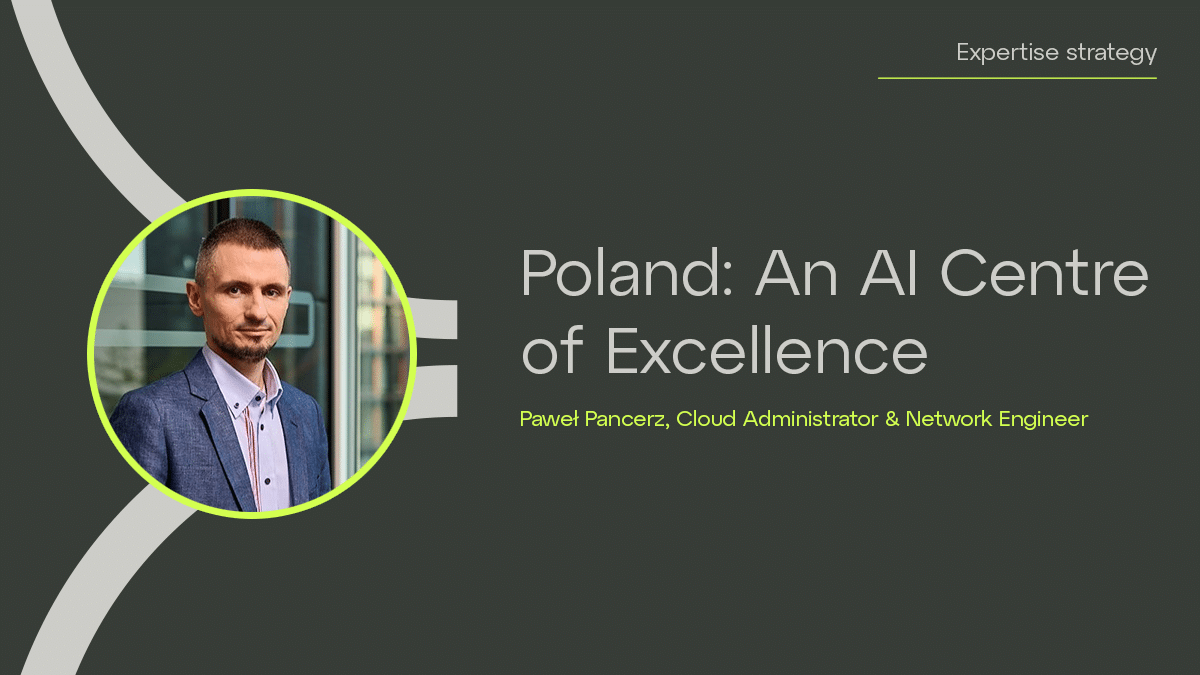

Optimise your KYC & AML processes with our strategic approach.

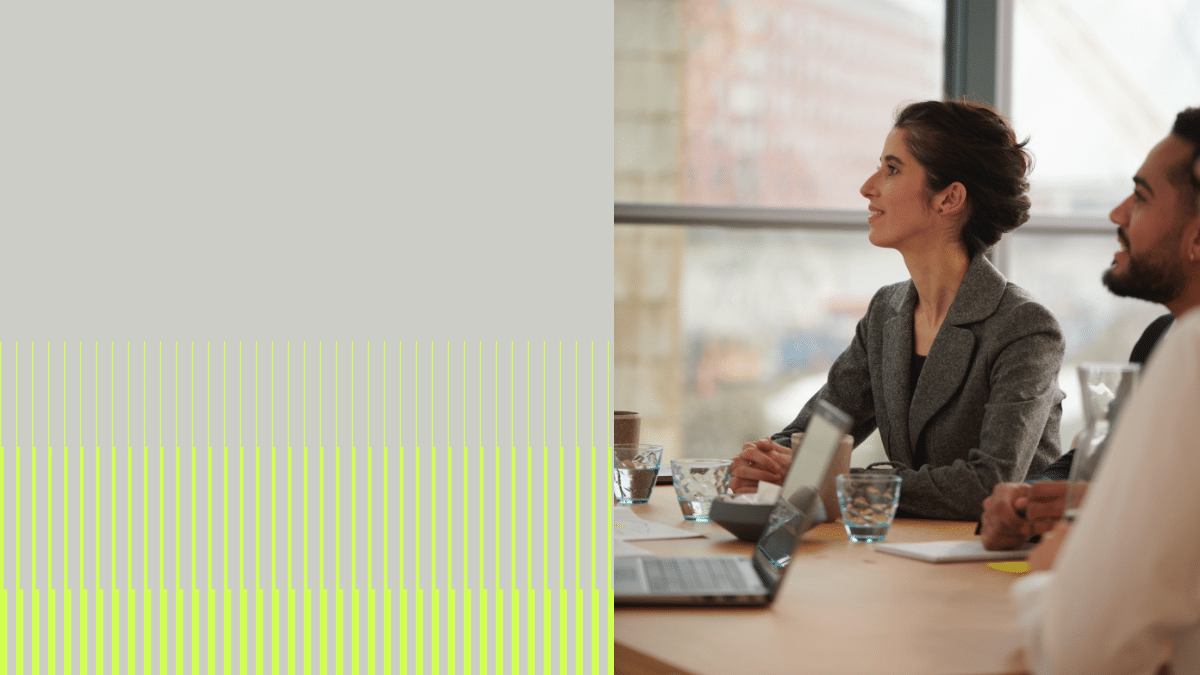

In an interconnected global economy, the integrity of financial systems is paramount. Protecting organisations against financial crimes like money laundering is not merely a regulatory requirement but a fundamental necessity for maintaining trust, stability, and ethical practices within the overall financial landscape.

Anti-Money Laundering (AML) processes are crucial for organisations, particularly in industries such as finance and banking but also any sector susceptible to significant financial transactions. For processes to operate ethically and securely whilst adhering to compliance, AML processes must be implemented to act as a protective shield against financial crimes and to enhance trust amongst stakeholders.

With digital payments developing further with time and cybercriminals becoming more agile, businesses must be aware of the pitfalls to cover their backs.

What are ALM processes?

We know that AML processes are the foundation of safe and secure business transactions, however, these procedures do often display hurdles that can slow down operations and lead to challenges.