Implementation Considerations

There are two considerations compliance teams must undertake before choosing to digitally transform the AMS components of long-standing KYB / KYC processes using solutions that combine several different approaches to AI-led analysis.

At the top of the list and, perhaps, the most-easily addressable question is the classic buy vs. build debate. While often the trickiest element associated with the introduction of new technology into any part of a CIB, the settlement of the argument of whether to use vendor-provided solutions to speed the uptake of the use of AI in AMS tends to hinge on the fact that commercial products often come pre-trained out-of-the-box on historical datasets well before they are ever deployed within a particular organisation. This pre-training allows the tools to mature rapidly, enabling analysis of complex data patterns from day one of implementation.

Next on the list is an institution’s assessment, pre-implementation, of the probability that a selected approach to the integration of an AI-centric solution – in-house built or vendor-built – into manual AMS processes will deliver return on investment. When proceeding with a commercial product selection process, a key consideration is arguably the ability of the application to realise time-save benefits across the most complex screening cases. For example, when dealing with intricate ownership structures or connected individual records, the efficiency of AI increases. In high-performance scenarios, an AI AMS tool can reduce a 10 to 20-minute manual review down to just two minutes. This reduction in manual overhead is also theoretically realizable for the screening of large corporate entities.

However, vendor selection processes must also consider the initial investment associated with commercial products, which is often much higher than in-house building due to licensing, integration and business user training. Therefore, AI should be viewed as a longer-term ROI and saving strategy rather than an overnight cost-cutting measure.

The Future of Compliance: Humans & Controls

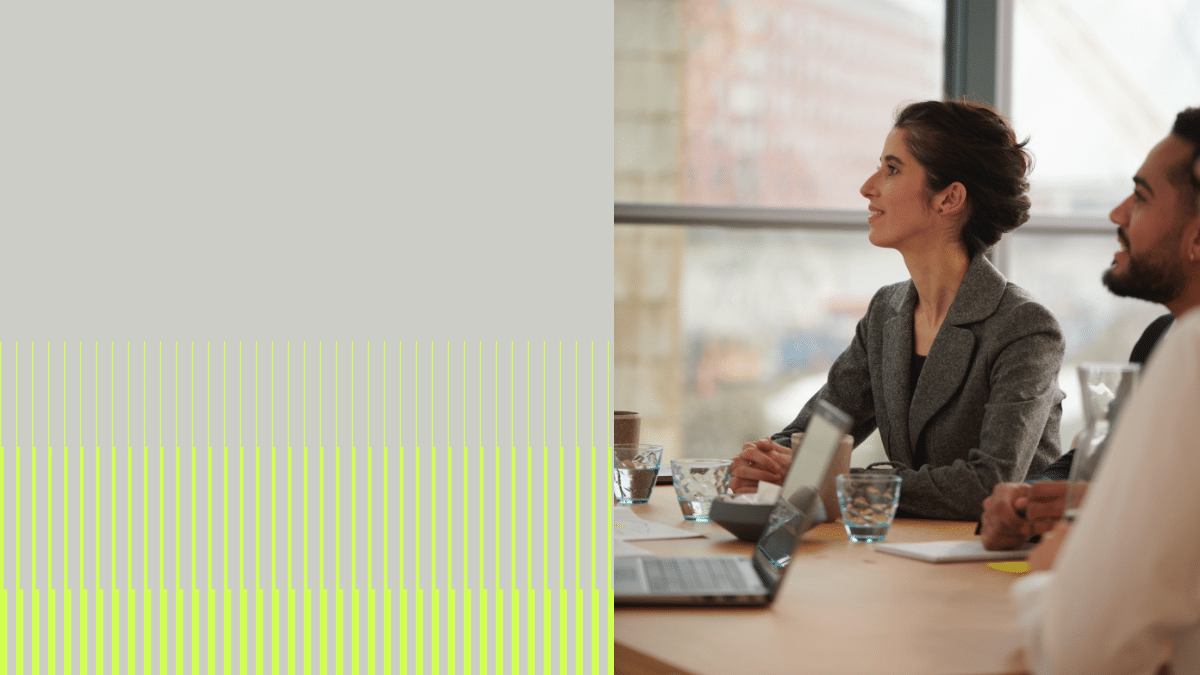

The final and, arguably, most crucial consideration for CIB compliance teams seeking greater automation of their AMS processes is the human question. The answer relies not on whether analysts can or should maintain their roles over time; despite the impressive capabilities of AI, institutions tend to still see human expertise in KYB / KYC assessment as indispensable.

Rather, the conversation for or against AI implementation tends to hinge on whether an institution is ready to digitally evolve further elements of its compliance function once it succeeds in fully or partially automating AMS. Herein, the best practices regarding the use of AI in any field are relevant, namely:

-

- Management of False Positives – Humans are required to review machine-generated alerts and request further information when an alert cannot be fully discounted;

- High-touch Intervention – For high-risk exercises – for example, screening Politically Exposed Persons – the narrative switches toward a partnership where human analysts and automated toolkits work together for optimised results;

- Spot / Point-in-Time Checks – Human operators should perform randomised reviews of AI-augmented systems to ensure an unbiased operation of the underlying code and its outputs; and

- Model Refinement – Humans are responsible for refining AI models, ensuring compliance with regulatory and ethical standards, and providing the contextual judgment that machines cannot replicate.

Simply put, CIBs must maintain robust control through human oversight of the usage of AI in any part of the business, but particularly across the realms of regulatory compliance operations. The transition to AI-driven AMS would represent a fundamental shift in how an institution could manage the prevention of financial crime, but the speed and scale at which ‘mostly automated’ assessments of client data or unique scenarios can only be mediated by the contextual judgment and oversight of experience human professionals.

In this partnership, an AI tool functions much like the autopilot function on an airplane; it handles the bulk of the data processing and monitoring, but it escalates critical issues to its human KYC team member for further investigation whenever a nuanced or complex decision is required. This dual approach not only reduces operational costs but also provides a more robust defence against the ever-growing complexities of global financial crime.

Would you like to know more? Talk to emagine to learn more about how AI AMS solutions can optimise adverse media screening across your businesses and reduce risk overall.